Tuition fees

All the students enrolled in PhD Programme benefit from tuition fees exemption. They need to pay only regional tax for financial aid. The stamp duty is also due only for students enrolled to the first year.

PhD Tuition fees a.y. 2025/2026 - amounts and deadlines

For the full academic year of 2025/2026 you need to pay only:

- the regional tax for financial aid (whose amount will be indicated in the next weeks)

- the 16,00 EUR stamp duty (only for students enrolled to the first year)

The regional tax for financial aid is calculated in proportion to the ISEE indicator for financial aid declared by the students, as shown in the following chart. The effective tax amount will be established after a recalculation of the tax balance by 30 September 2025 (or by 18 December 2025 with the penalty surcharge of EUR 50,00) on submission of both documents:

- benefits application form, to be compiled and submitted online in the personal area;

- ISEE certification for financial aid

One instalment

The only instalment should be paid by:

- first year students prior to the deadline indicated in the call;

- all other students by 30 September 2025.

If the amount of regional tax for financial aid exceeds the amount effectively due, the difference will be refunded during the Summer exclusively by payment onto your University CartaConto.

Penalty surcharge

Late payment is permitted only for students enrolling in their second year or successive years. It involves the following penalty surcharge:

- EUR 50,00 for the payment of the instalment from 1 October 2025 to 30 October 2025;

- EUR 100,00 for the payment of the instalment from 31 October 2025 onwards.

The penalty surcharge is automatically generated upon receipt of payment.

Tuition fees other academic years

For the full academic year of 2024/2025 you need to pay only:

- the regional tax for financial aid of 186,00 EUR

- the 16.00 EUR stamp duty (only for students enrolled to the first year)

The regional tax for financial aid is calculated in proportion to the ISEE indicator for financial aid declared by the students, as shown in the following chart. The effective tax amount will be established after a recalculation of the tax balance by 30 September 2024 (or by 17 December 2024 with the penalty surcharge of EUR 50,00) on submission of both documents:

- benefits application form, to be compiled and submitted online in the personal area;

- ISEE certification for financial aid

| Fascia | Valori ISEE | Importo tassa regionale |

|---|---|---|

| 1 | da 0,00 Euro a 15.748,78 Euro | da 142,00 a 161,99 Euro |

| 2 | da 15.748,79 Euro a 31.497,56 Euro | da 162,00 a 185,99 Euro |

| 3 | da 31.497,57 in poi | 186,00 Euro |

One instalment

The only instalment should be paid by:

- first year students prior to the deadline indicated in the call;

- all other students by 30 September 2024.

If the amount of regional tax for financial aid exceeds the amount effectively due, the difference will be refunded during the Summer exclusively by payment onto your University CartaConto.

Penalty surcharge

Late payment is permitted only for students enrolling in their second year or successive years. It involves the following penalty surcharge:

- EUR 50,00 for the payment of the instalment from 1 October 2024 to 30 October 2024;

- EUR 100,00 for the payment of the instalment from 31 October 2024 onwards.

The penalty surcharge is automatically generated upon receipt of payment.

For the full academic year of 2023/2024 you need to pay only:

- the regional tax for financial aid of EUR 184,00

- the 16,00 EUR stamp duty (only for students enrolled to the first year)

The regional tax for financial aid is calculated in proportion to the ISEE indicator for financial aid declared by the students, as shown in the following chart. The effective tax amount will be established after a recalculation of the tax balance by October, 2nd 2023 (or by 19 December 2023 with the penalty surcharge of EUR 50,00) on submission of both documents:

- benefits application form, to be compiled and submitted online in the personal area;

- ISEE certification for financial aid

| Fascia | Valori ISEE | Importo tassa regionale |

|---|---|---|

| 1 | da 0,00 Euro a 15.748,78 Euro | da 139,00 a 159,99 Euro |

| 2 | da 15.748,79 Euro a 31.497,56 Euro | da 160,00 a 183,99 Euro |

| 3 | da 31.497,57 in poi | 184,00 Euro |

One instalment

The only instalment should be paid by:

- first year students prior to the deadline indicated in the call;

- all other students by October, 2nd 2023.

If the amount of regional tax for financial aid exceeds the amount effectively due, the difference will be refunded during the Summer exclusively by payment onto your University CartaConto.

Penalty surcharge

Late payment is permitted only for students enrolling in their second year or successive years. It involves the following penalty surcharge:

- EUR 50,00 for the payment of the instalment from October, 3rd 2023 to November, 2nd 2023;

- EUR 100,00 for the payment of the instalment from November, 3rd 2023 onwards.

The penalty surcharge is automatically generated upon receipt of payment.

For the full academic year of 2022/2023 you need to pay only:

- the regional tax for financial aid of EUR 176.00

- the 16.00 EUR stamp duty (only for students enrolled to the first year)

The regional tax for financial aid is calculated in proportion to the ISEE indicator for financial aid declared by the students, as shown in the following chart. The effective tax amount will be established after a recalculation of the tax balance by October, 3rd 2022 (or by 19 December 2022 with the penalty surcharge of EUR 50,00) on submission of both documents:

- benefits application form, to be compiled and submitted online in the personal area;

- ISEE certification for financial aid

| Fascia | Valori ISEE | Importo tassa regionale |

|---|---|---|

| 1 | da 0,00 Euro a 15.748,78 Euro | da 133,00 a 152,99 Euro |

| 2 | da 15.748,79 Euro a 31.497,56 Euro | da 153,00 a 175,99 Euro |

| 3 | da 31.497,57 in poi | 176,00 Euro |

One instalment

The only instalment should be paid by:

- first year students prior to the deadline indicated in the call;

- all other students by October, 2nd 2022.

If the amount of regional tax for financial aid exceeds the amount effectively due, the difference will be refunded during the Summer exclusively by payment onto your University CartaConto.

Penalty surcharge

Late payment is permitted only for students enrolling in their second year or successive years. It involves the following penalty surcharge:

- EUR 50,00 for the payment of the instalment from October, 4th 2022 to November, 2nd 2022;

- EUR 100,00 for the payment of the instalment from November, 3rd 2023 onwards.

The penalty surcharge is automatically generated upon receipt of payment.

How to pay

University fees will be paid through the new PagoPa system, which guarantees secure and trustworthy electronic payments to Public Administrations.

All Public Administrations must adhere to this initiative, which is promoted by the Presidency of the Council of Ministers.

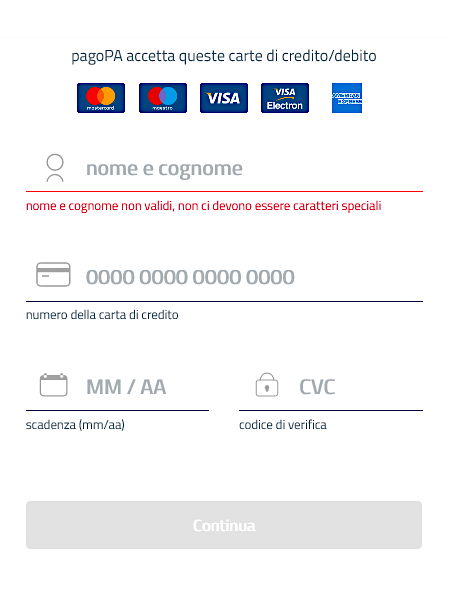

You can choose among the following options:

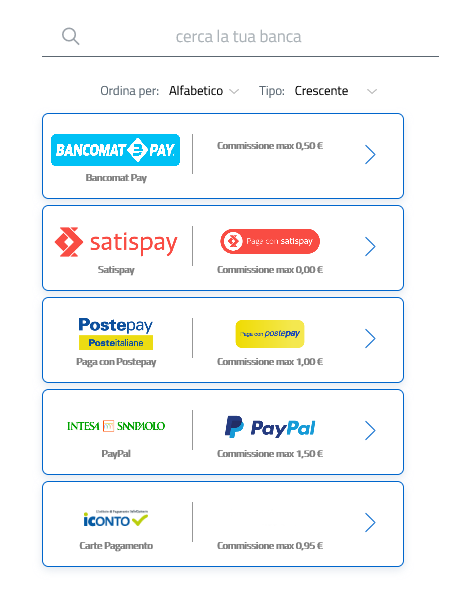

Click on "Pay Online" and choose among the following options:

1. Credit Card. PagoPA accepts the following debit/credit cards:

- Mastercard

- Maestro

- Visa

- Visa electron

- American Express

Once you have entered your credit card details you will be directed to the payment page;

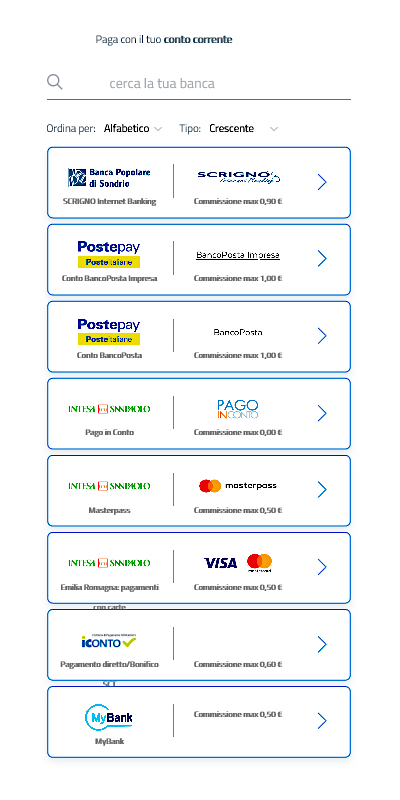

2. Current Account. The following banks can provide for this service:

- Banco Popolare di Sondrio

- Postepay - Poste italiane – Carta Banco posta impresa

- Postepay - Poste italiane – Carta Banco posta

- Intesa Sanpaolo – Pago in conto

- Intesa Sanpaolo – Masterpass

- Intesa Sanpaolo – Visa/Mastercard

- Io conto – pagamento diretto bonifico

- My bank – find your bank in the list of licensed banks; if you find your bank, please select it and you will be directed to the home banking page and carry out the payment;

Print the Payment Notification. You can proceed to the payment in the following ways:

- Through the desk of a credit institute which is part of the PagoPA system;

- At a tobacco seller shop or facility enrolled in the PagoPa system, or at an ATM authorised to provide this service;

- By using the CBILL [ITA] circuit. To carry out the payment you should use the code number of the body “4P316” and add the code of the payment notification.

The payment will be automatically recorded within our management system over the days subsequent to the payment.

Monitoring payment status

Log on to your personal area in www.unive.it and select Student Service Office > Payments [ITA] to check:

- status of payment

- amount due for instalment

Tax deduction of tuition fees

You can deduct the expenses resulting for enrolment in university programs when making your income statement. Deductible expenses include tuition fees for students enrolling on PhD program.